Keep your data private with Avast Secure Browser for Android

- Security

- Privacy

- Performance

Identity theft is on the rise — and becoming a victim can leave your bank account empty, your credit wrecked, and your chances of getting a loan in ruins. That’s why reporting a stolen identity immediately is so important. Keep reading to learn how to report identity theft. Then, get strong identity-protection software to make sure your data and identity stay secure.

If you’ve become a victim of identity theft, immediately change the login information and passwords on your affected accounts, notify your credit card companies, and file an identity theft report with the relevant governmental authority. The identity theft report launches an investigation, so you can recover your stolen identity and clear your name.

This Article Contains:

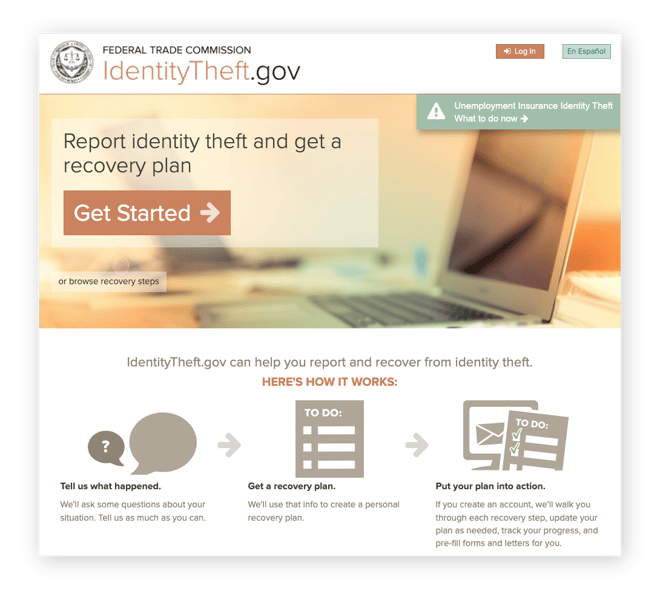

If you’re in the US, file an identity theft report with the Federal Trade Commission (FTC) and get a personalized plan to guide you through the recovery process. In the UK, report the theft to Action Fraud — they’ll send your report to the National Fraud Intelligence Bureau (NFIB), who investigate reports across the country.

Your completed FTC identity theft report will help you when you contact the police and credit bureaus — it proves that you’ve taken steps to mitigate the damage and are prepared to catch the fraudsters.

The Federal Trade Commission (FTC) is a US government agency committed to consumer protection. Filing an identity theft report with the FTC alerts them that fraud has taken place with your personal information. Your FTC report will come in handy later when you report fraud to the police and credit bureaus.

Here’s how to report identity theft to the Federal Trade Commission:

Contact them. You can contact the FTC online or by phone at 1-877-FTC-HELP.

Complete an FTC identity theft report. Provide as much information as possible about the fraud, and be as honest as possible.

Follow the recovery plan. The FTC will send you a detailed recovery plan based on the information you provided in the FTC identity theft affidavit.

Contact other relevant authorities. This includes credit card companies, your bank, and, in some cases, the police.

If you’re in the UK, report identity theft to Action Fraud, the country’s national reporting body for fraud and cybercrime. Doing so will open an investigation with the National Fraud Intelligence Bureau.

While the identity theft investigation is in progress, use an online data leak monitoring tool to check your online accounts for leaks. If your info comes up in a data breach, update your login information and passwords immediately to ensure your digital identity is safe.

While an FTC identity theft report is an official report of the crime, you may also want to file a police report. Reporting cyber crimes can be difficult, since you may not know who the thief is. But if you know your information was fraudulently used in previous police reports — even minor infractions like traffic or noise violations — filing a police report may help your case.

Sometimes, creditors or other companies require you to report identity theft to the police before they process your claim. If you’re the victim of a scam, reporting this information may also help local police, if the scammers are targeting a specific location.

Here’s what you’ll need to report identity theft to the police:

Your FTC identity theft report. Providing the completed report guarantees you certain rights when contacting businesses to report the scam and request records.

Evidence of identity theft. Collecting records of suspicious bank transactions, bills for unreceived medical treatment, tax refund notifications, or any other suspicious activity on your personal accounts will help your case. The police will want to see evidence that identity theft occurred.

Your personal ID. Reporting identity theft to the police isn’t possible if you can’t prove your own identity. Make sure to have at least one government-issued photo ID.

Proof of address. Verifying your identity will be a top priority before the report can be filed — your verified address will help. Plan to show a lease, utility bill, or a mortgage statement with your verified address.

If you notice suspicious activity on your credit card or your credit report, report identity theft to the credit bureaus immediately. They will set up fraud alerts in your name to ensure credit lenders verify your identity before issuing you more credit. According to the Federal Trade Commission, credit card fraud reports have doubled since 2018.

Here’s what to do when reporting identity theft to the credit bureaus:

Contact one of the main credit bureaus. The three main bureaus in the US (and the UK) are Experian, TransUnion, and Equifax. You only need to report the theft to one credit bureau — they should contact the other two for you — but you can contact all three bureaus yourself if you prefer.

Set up a fraud alert. Most initial fraud alerts last for one year. But, if you’ve already filed an FTC identity theft report or police report, the initial fraud alert can usually be extended by several years automatically.

Review your credit reports. Make sure that all of the accounts are known to you.

If your identity is stolen, your passwords could be compromised. Immediately change the passwords of all your accounts, using strong, unique passwords for each account (and a password manager to keep track of them).

If your credit card was stolen, cancel it. Most credit card companies and banks have an emergency contact number to call if your actual card or card number has been stolen. Check recent activity on the stolen card and report any fraudulent transactions during this call too.

Freezing your credit prevents thieves from opening other accounts in your name, because credit card companies won’t be able to access your credit reports. But freezing your credit will also prevent you from accessing your credit reports, so plan accordingly.

Companies connected to the identity theft may include retail stores where credit cards were opened without your consent, or stores where your stolen card or card number was used. In some cases, thieves may have even applied for jobs with your name or information — contact these companies as well.

Once you’ve reported your identity theft, financial institutions like your bank or investment account can send you new bank cards or login information for all your relevant accounts. In some cases, they may be able to reimburse you for stolen funds.

After you’ve reported your identity theft to the relevant government agencies (like the FTC), the police, and credit bureaus, there are a few more things you can do to continue protecting your identity in the future.

Here are additional ways to protect your identity after you’ve set up fraud alerts and filed official reports:

You might still have some accounts that didn’t get closed or blocked in the wake of identity theft, or you might need to open new accounts with your updated information. Keep track of these other accounts and monitor them for any fraudulent activity.

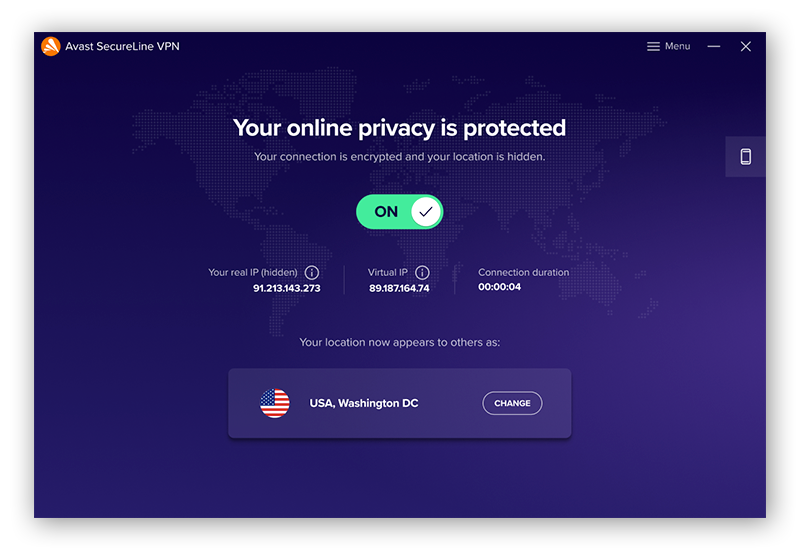

To prevent becoming a victim of identity theft again, start making a prevention plan. Keep your data off the dark web’s many marketplaces with tools like Avast BreachGuard. Or, browse the web using a free Virtual Private Network (VPN) for PC (or a VPN for Mac), which encrypts your internet connection and prevents your IP address and other identifying information from being seen or stolen by hackers.

Just like any other form of stealing, identity theft is a crime — often a cybercrime. It’s committed when someone steals your personal information or other personally identifying data floating around online. Signs of identity theft include unexplained bills, unfamiliar login alerts, suspicious bank activity, or being denied credit unexpectedly. Visit our guide to identity theft to learn more.

No one is immune to identity theft. With companies increasingly vulnerable to data breaches, safeguarding your information online isn’t easy. But with the right tools, you can bolster your security and minimize your risk.

Avast BreachGuard — a comprehensive data-leak monitoring tool — will help you check to see if your personal info or passwords have leaked, and it will help you take the necessary steps to secure your data. BreachGuard will also help you remove your personal information from data brokers’ databases, to help your data stay private. Get Avast BreachGuard and keep your identity and your personal data safe.

Get Avast BreachGuard for Mac to prevent identity theft and fraud and keep your personal data private.

Get it for PC

Get Avast BreachGuard for PC to prevent identity theft and fraud and keep your personal data private.

Get it for Mac

Get Avast BreachGuard for Mac to prevent identity theft and fraud and keep your personal data private.

Get it for PC

Get Avast BreachGuard for PC to prevent identity theft and fraud and keep your personal data private.

Get it for Mac

Keep your data private with Avast Secure Browser for Android

Keep your data private with Avast Secure Browser for iOS